All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the money value of an IUL are usually tax-free up to the quantity of premiums paid. Any type of withdrawals over this quantity may undergo taxes relying on policy framework. Traditional 401(k) contributions are made with pre-tax bucks, decreasing gross income in the year of the contribution. Roth 401(k) contributions (a plan feature readily available in a lot of 401(k) strategies) are made with after-tax contributions and after that can be accessed (incomes and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the person is over 59. Possessions withdrawn from a traditional or Roth 401(k) before age 59 might sustain a 10% charge. Not exactly The claims that IULs can be your own bank are an oversimplification and can be misguiding for numerous factors.

You may be subject to upgrading associated wellness concerns that can affect your recurring expenses. With a 401(k), the cash is constantly your own, including vested company matching no matter of whether you give up adding. Risk and Warranties: First and leading, IUL plans, and the cash money worth, are not FDIC guaranteed like basic savings account.

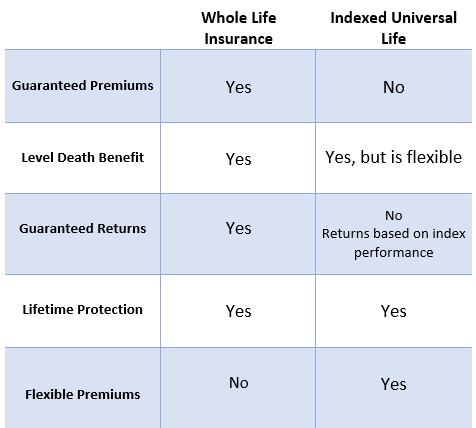

While there is generally a flooring to avoid losses, the development potential is topped (implying you may not completely gain from market growths). The majority of experts will concur that these are not similar products. If you desire death advantages for your survivor and are worried your retirement financial savings will not suffice, then you may wish to think about an IUL or other life insurance policy item.

Certain, the IUL can provide accessibility to a cash account, however again this is not the primary objective of the item. Whether you desire or require an IUL is an extremely individual question and depends upon your key monetary purpose and goals. Listed below we will certainly try to cover advantages and constraints for an IUL and a 401(k), so you can better define these items and make a much more enlightened decision relating to the finest way to handle retirement and taking care of your enjoyed ones after death.

Is Indexed Universal Life A Good Investment

Funding Costs: Finances versus the policy accrue rate of interest and, if not paid back, minimize the survivor benefit that is paid to the recipient. Market Participation Restrictions: For many plans, financial investment growth is linked to a stock exchange index, but gains are usually covered, limiting upside prospective - iul index universal life. Sales Practices: These policies are typically sold by insurance policy representatives that may stress benefits without totally clarifying costs and dangers

While some social media experts suggest an IUL is an alternative item for a 401(k), it is not. Indexed Universal Life (IUL) is a kind of permanent life insurance plan that additionally supplies a cash value component.

Latest Posts

What Is Equity Indexed Universal Life Insurance

529 Plan Vs Iul

Dave Ramsey Iul